The Online Broker Evaluation Framework (OBEF)

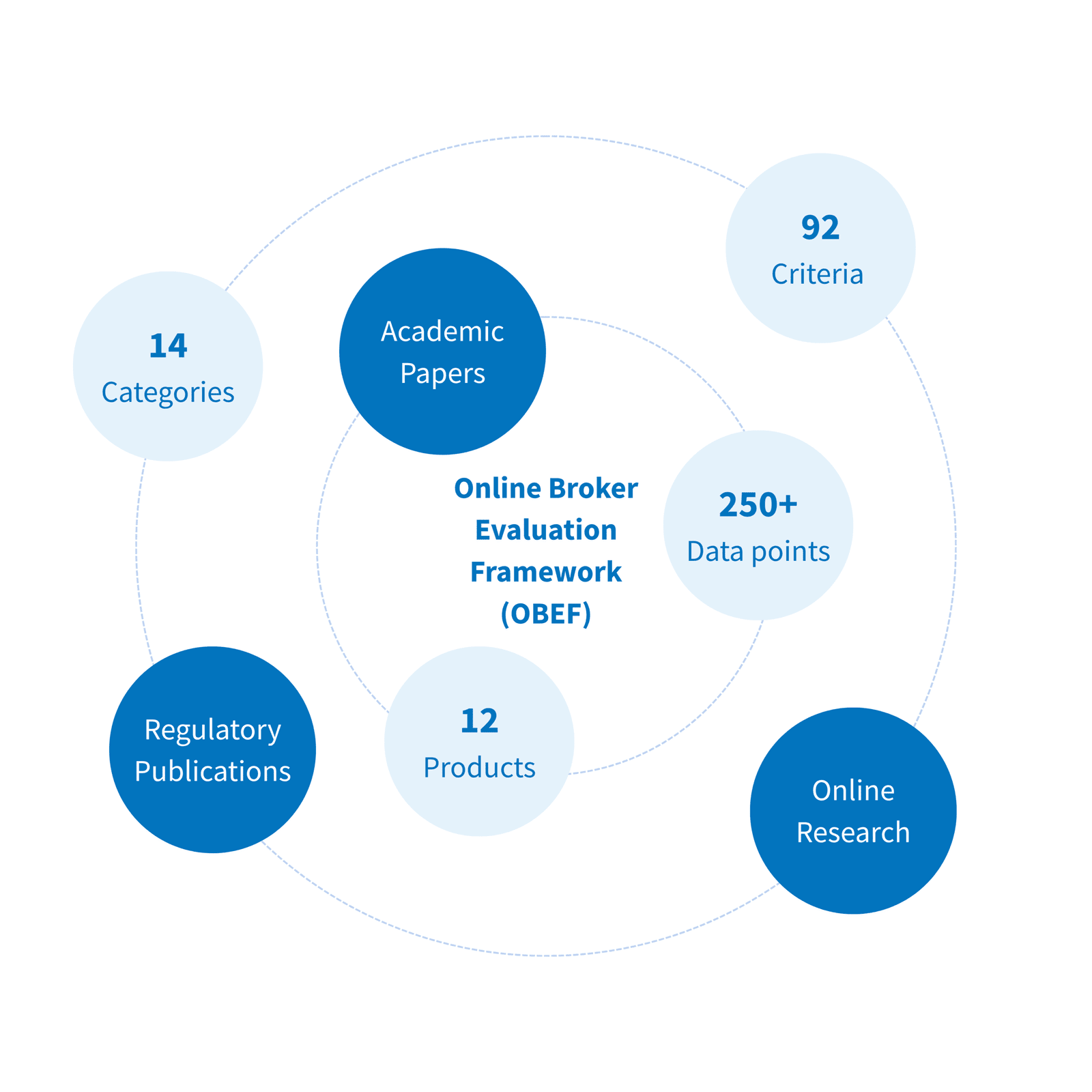

Private Investor Alliance uses a structured, research-based framework to evaluate online brokers across Europe. The OBEF analyzes each broker using over 250 data points, grouped into 92 criteria across 14 key categories—from asset safety and to hidden fees.

PIA collects data through online research and validated through a peer review process. PIA developed a scale model inspired by scientific research.

Scoring Model

Each online broker receives a score from 0 (lowest) to 100 (highest), helping investors compare providers transparently and confidently.

See below how to interpret the scores. Go to our Compare page to review the latest rankings.

How do we uniquely compare brokers?

PIA us using 14 Evaluation Categories, carefully chosen based on scientific research, regulatory frameworks, and industry best practices.

Each category addresses a critical question about broker quality and uses multiple criteria to provide a rigorous, transparent, and trustworthy assessment.

Category 1: Asset Safety

Key question: Are investor assets safe in case the online broker goes bankrupt?

Why it matters: Investors need to know their assets are protected if the broker fails for any reason. This category checks legal, structural, and financial safeguards for client assets (stocks, bonds, structured products, cash).

PIA category weight: 14 / 100

Ranking Criteria:

Asset Custody Structure

Government Protection Scheme

Client Funds Segregation

Regulatory License

Insurance Beyond State Protection

Category 2: Investment Behavior

Key question: Does the online broker promote good investment behavior?

Why it matters: A broker should encourage long-term, rational investing—not impulsive trading. This category evaluates how well the platform promotes healthy financial habits and minimizes harmful incentives.

PIA category weight: 12 / 100

Ranking Criteria:

- Max Leverage Limits

- Gamification tendencies

- Push Notifications frequency / intent

- Special Offers to Promote more trading

- Mandatory testing of investor skills

- Ease of withdrawal/account closure

- Portfolio risk visualization

- Auto-invest / Recurring investment

- Fractional shares support

Category 3: Trustworthiness

Key question: Is the legal company behind the broker transparent and credible?

Why it matters: A broker may be cheap or feature-rich, but if it’s not credible, transparent, or stable, investor money could be at risk. This category assesses how trustworthy the company behind the platform really is.

PIA category weight: 11 / 100

Ranking Criteria:

- User size

- Country of Residence

- Years in Operation

- Bad Press Checks

- Investors / Ownership

- Funding (IPO, VC, etc.)

- Promoters / Ambassadors

- Online Reviews

- Fee Transparency

Category 4: Cost & Fees

Key question: Is the service affordable/cheap?

Why it matters: Fees eat substantially into long-term returns. This category measures how cost-effective the platform is for both active and passive investors, including hidden and non-obvious costs.

PIA category weight: 10 / 100

Ranking Criteria:

- Pay-in / Pay-out Fees

- Currency Conversion Fees

- Subscription Fees

- Inactivity Fees

- Custody / Holding Fees

- Exchange / Market Access Fees

- Leverage / Margin Fees

Category 5: Education

Key question: Does the platform help educate on good investment practices?

Why it matters: Education empowers investors to make informed decisions. Brokers that provide quality learning resources help users build knowledge and confidence, reducing risky behavior.

PIA category weight: 9 / 100

Ranking Criteria:

- Mandatory testing for complex products

- Access to educational materials

- Community & social features

- Educational content formats

- Multi-language content

- Contextual learning during order execution

Category 6: User Experience

Key question: Does the platform provide a smooth, intuitive, and accessible experience that helps users invest confidently?

Why it matters: A smooth, intuitive platform helps users focus on investing, not navigating. UX impacts confidence, accessibility, and how likely users are to stick with their investment plan.

PIA category weight: 8 / 100

Ranking Criteria:

- Speed and responsiveness of app

- Visual design & simplicity

- Feature overload

- Onboarding UX (tooltips, guidance)

- Accessibility options

Category 7: Market Access

Key question: Does investor have access to a wide range of investments?

Why it matters: Investors need access to a wide range of products to build diversified portfolios. This category checks how many markets, asset types, and instruments are available through the platform

PIA category weight: 7 / 100

Ranking Criteria:

- Number of instrument types

- Number of tradable securities

- Geographical coverage

- Exchange venue access

- Guiding questionnaires

- Access to ETFs, Funds, Bonds, Crypto

- Tax-wrapped account support

- Fractional shares availability

Category 8: Transparency & Disclosure

Key question: Is the broker open and honest about how it operates, makes money, and handles trades?

Why it matters: Trustworthy brokers clearly explain how they operate, make money, and handle orders. This category evaluates whether users are fully informed and protected from hidden conflicts.

PIA category weight: 6 / 100

Ranking Criteria:

- Business model clarity

- Order execution policy transparency

- Payment for order flow (PFOF) disclosure

- Clarity of terms & risk disclaimers

- Conflict of interest statement

Category 9: Insights & Analysis

Key question: Does the platform offer useful and easy to interpret insights?

Why it matters: Understanding how investor portfolio performs and what they are investing in is critical. Platforms should offer actionable insights—not just data—so users can invest with clarity and confidence.

PIA category weight: 5 / 100

Ranking Criteria:

- Portfolio insights

- Performance indicators

- Company financials

- Trading KPIs / valuation metrics

- Analyst info / ratings

- Company news & events

- Benchmark comparison

- Risk vs. reward visualization

- Alerts & notifications

Category 10: Sustainability

Key question: Does the online broker support sustainable & ethical investing?

Why it matters: Many investors want their money to align with their values. Brokers that support sustainable investing make it easier to avoid harmful industries and focus on ethical, climate-friendly opportunities.

PIA category weight: 5 / 100

Ranking Criteria:

- Sustainability scores displayed

- Filters for ESG / sustainable products

- Green/ethical investment education

- Exclusion filters (negative screening)

Category 11: Cash Interest

Key question: Does it offer interest % return on cash held in the account?

Why it matters: Uninvested cash shouldn’t sit idle. Platforms that pay interest on cash balances help users earn passive returns, especially important during high interest rate environments.

PIA category weight: 4 / 100

Ranking Criteria:

- % Interest on cash balance

- Frequency of payout

- Transparency in calculation

- Guarantees in case of bankruptcy

- Interest type (fixed/variable)

- Minimum balance for interest

Category 12: Customer Support

Key question: Does the broker offer good customer support?

Why it matters: When things go wrong—or users need help fast—clear support builds trust. A platform’s support quality directly affects user satisfaction, especially during onboarding, trading issues, or withdrawals.

PIA category weight: 4 / 100

Ranking Criteria:

- Support channels available

- Speed of response

- Clarity & helpfulness of responses

- Online self-help resources

- Language support

- Human vs. bot support

Category 13: Tax Tools

Key question: Does the broker provide tax reporting tools?

Why it matters: Filing taxes on investments is often complex and country-specific. Brokers that simplify tax reporting help users stay compliant, reduce friction, and save time (and money).

PIA category weight: 4 / 100

Ranking Criteria:

- Tax statement availability

- Capital gains/dividend summary

- Real-time tax estimation

- Tax-loss harvesting tools

Category 14: Onboarding

Key question: Is onboarding smooth and fast?

Why it matters: A smooth, transparent onboarding process builds trust and lowers barriers to getting started. Friction, unclear steps, or excessive requirements can cause users to drop off.

PIA category weight: 4 / 100

Ranking Criteria:

- Documents required

- Clarity of steps

- Support during onboarding

Are you a registered journalist working on improving the investment environment for the retail investors? Gain free access to PIA’s updated database by getting in touch via email at: info@privateinvestoralliance.com